Credit Card import templates can be added, edited, copied or removed from multiple locations within Sage Intacct Paperless.

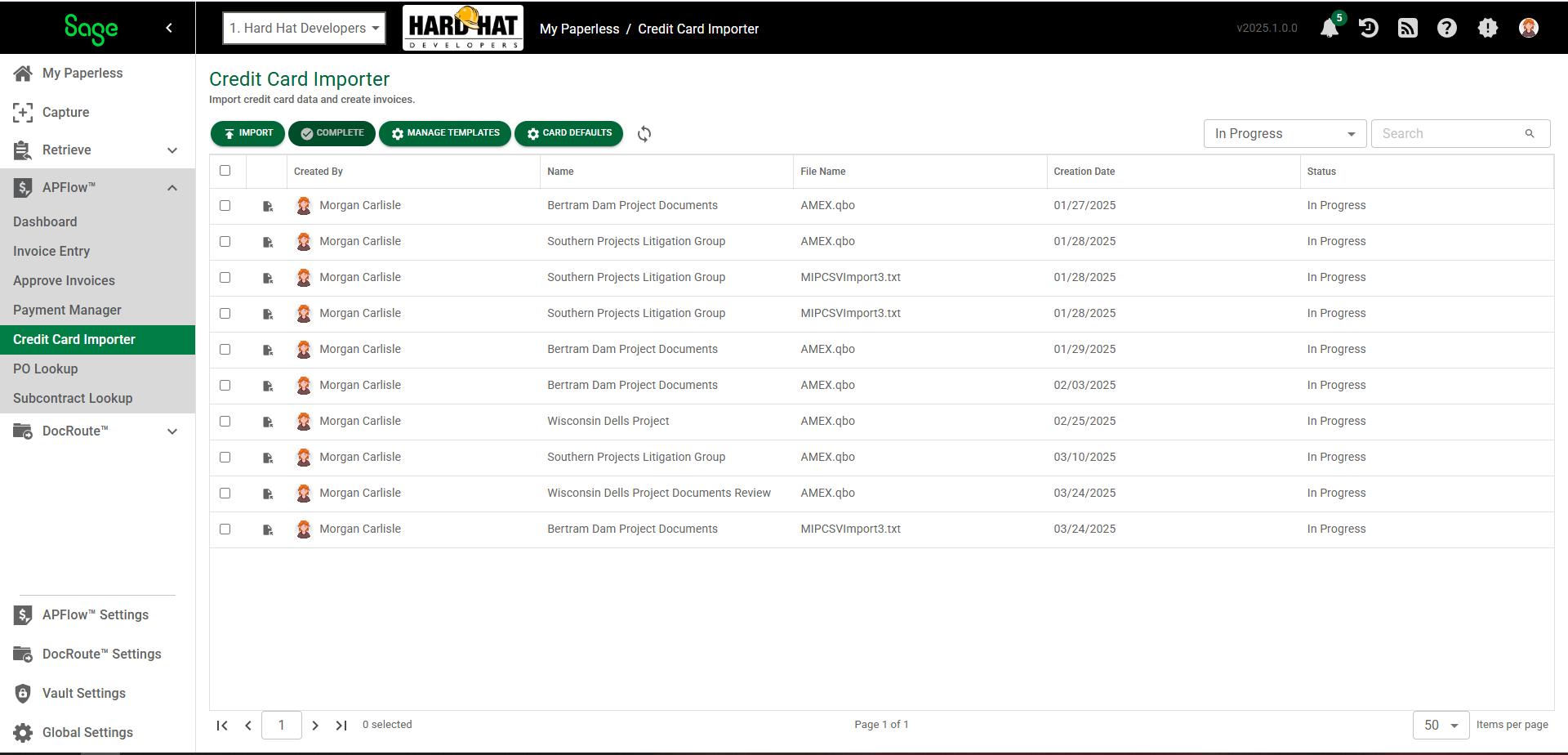

1.From My Paperless, click APFlow™.

2.From the APFlow™ navigation bar dropdown, click Credit Card Importer.

The Credit Card Importer page similar to the following displays:

If the credit card statement uses one of the three standard formats, refer to the Industry Standard File sub topic.

If the credit card statement does not use one of the three standard formats and a template must be created, skip to the Template-based Import sub topic.

Industry Standard File

1.Download the credit card statement from the credit card provider.

2.Look at the file extension.

Most credit card companies offer the ability to download credit card statements into one of three standard download formats:

•Quicken (.qfx)

•Quickbooks (.qbo)

•Microsoft Money (.ofx)

3.On the Credit Card Importer page, click  .

.

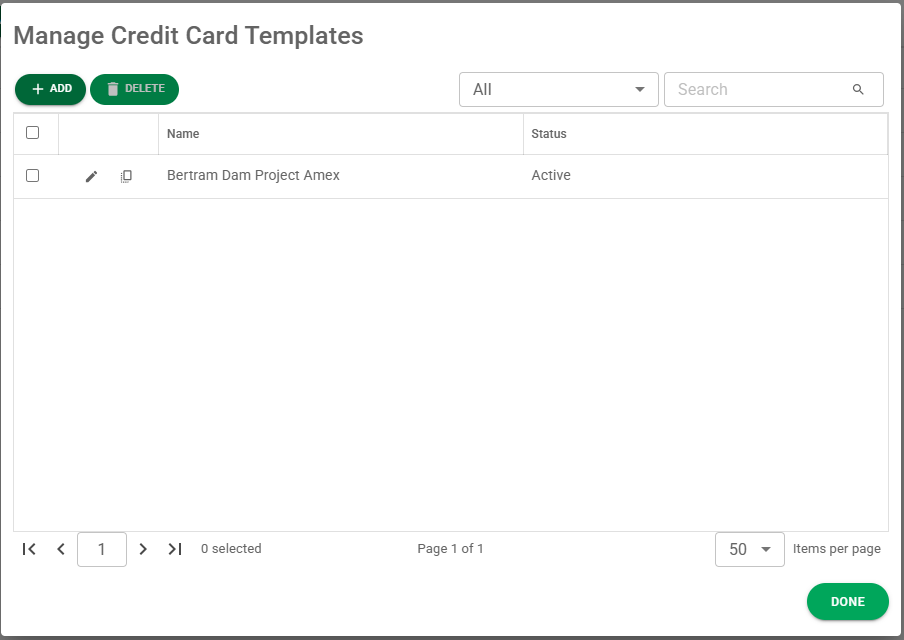

The Manage Credit Card Templates page displays:

4.Click  .

.

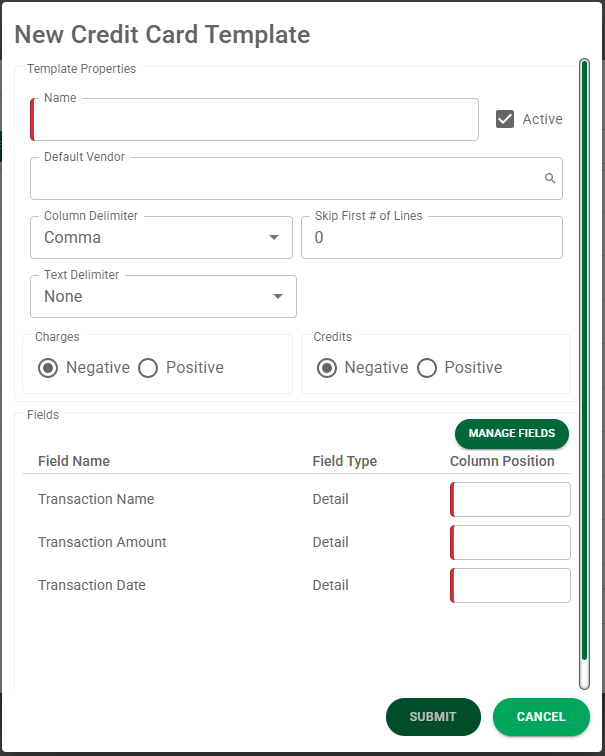

A New Credit Card Template dialog box displays:

Important: You must populate all required fields before clicking  .

.

5.In the Name field, enter an appropriate name for the template. This is a required field.

Note: The Active check box is selected by default. If this template should not be active, click the check box to remove the checkmark.

6.In the Default Vendor field, click the lookup icon, ![]() , to locate the vendor.

, to locate the vendor.

The Vendor ID associated with the selected vendor displays in the Default Vendor field.

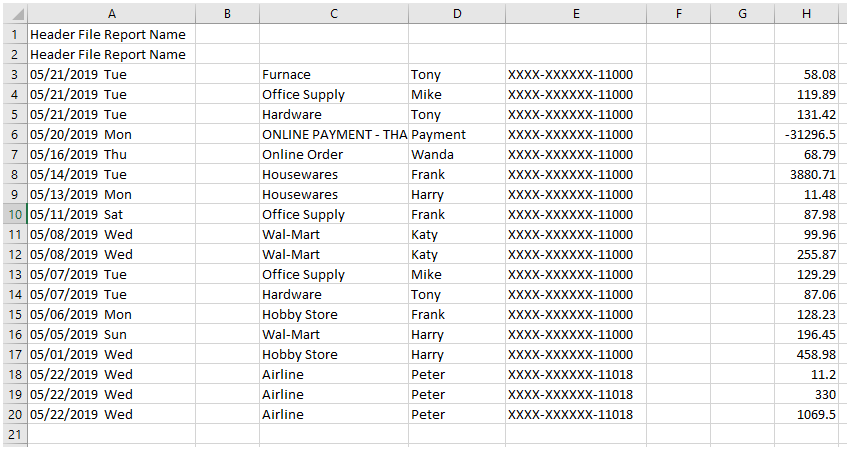

7.Open the credit card statement in Excel. Identify the column locations. Determine whether Charges and Credits are negative or positive. Look to see if initial, header lines exist.

In this Excel sample, the header file occupies rows 1 and 2. The Transaction Date is column 1, the Vendor is column 3 and the Transaction Amount is column 8.

Charges are positive and Credits are negative.

8.Open the credit card statement in Notepad to discover how the columns are separated and whether double quotes or single quotes are present.

The format may resemble the following:

Type,Trans Date,Post Date,Description,Amount,Category,Memo

Sale,08/03/2018,08/05/2018,ULTA #337,-51.14,,null

Sale,07/30/2018,07/31/2018,SHOE STATION #17,-115.48,,null

Sale,07/30/2018,07/31/2018,ACADEMY SPORTS #51,-82.42,,null

Payment,07/25/2018,07/25/2018,Payment Thank You-Mobile,"2,000.00",,null

Sale,07/21/2018,07/24/2018,WENDYS #1813,-18.22,,null

In this Notepad sample, the columns are separated by commas and double quotes are used.

9.In the Column Delimiter field, use the dropdown list to select from one of the following:

•Comma

•Tab

•Space

•Pipe

Using the Notepad sample, Comma is the correct choice for the Column Delimiter field.

10. Enter the number of header lines in the Skip First # of Lines field.

Using the Excel sample as a reference, 2 is the correct choice for the Skip First # of Lines field.

11. Text delimiters are typically used when the column delimiter is part of the value--in the case of commas in a currency value for instance--which may not be used on every line. In the Text Delimiter field, use the dropdown to select one of the following:

•None

•Single Quote

•Double Quote

Using the Notepad sample, Double Quote is the correct choice for the Text Delimiter field.

In the Notepad sample, there is an amount listed that includes a comma and is surrounded by double quotes: "2,000.00".

If None were to display in the Text Delimiter field, the 2,000.00 entry would "be read" by the system as 2.

12. Identify if the charges on the credit card statement in Excel are listed as Negative or Positive. In the Charges text box, click the appropriate radio button.

Using the Excel sample, the charges display as positive numbers.

13. Identify if the credits on the credit card statement in Excel are listed as Negative or Positive. In the Credits text box, click the appropriate radio button.

Using the Excel sample, the credits display as negative numbers.

14. In the Field Name / Column Position box(es), the following fields are required:

•Transaction Date

•Transaction Amount

•Transaction Name

15. Click  to select other field names.

to select other field names.

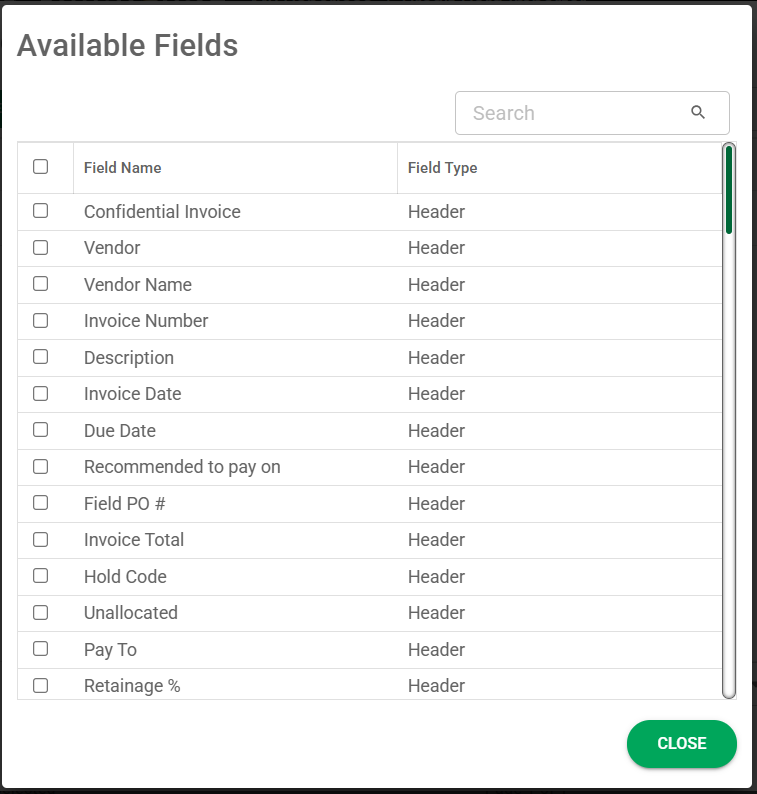

The following dialog box displays:

For example, using the Excel sample, the Date Posted column is 1, the Amount column is 8 and the Description column is 3.

16. Click  .

.

The credit card statement using the template will display. This is how to determine if the information added to the Template Properties area of the Add Credit Card Template page accurately reflects the associated credit card file.

Note: This is an optional step.

Important

•The Credit column is used when debits and credits are not combined in the same column in the file. When this occurs, set the Transaction Amount to the debit column and Credit to the credit column.

•Any field in the Invoice Entry line section may be mapped to a field in the template.