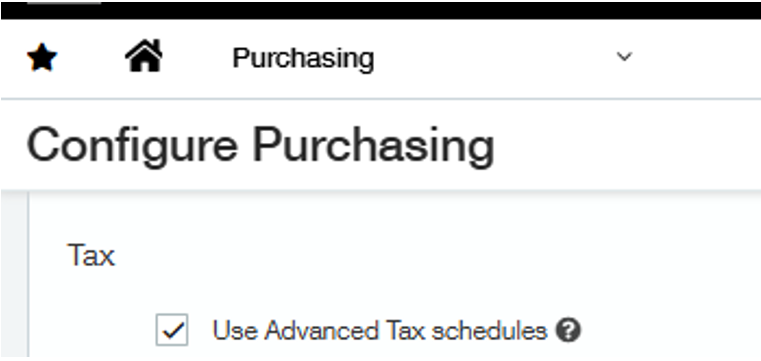

Advanced Taxes is implemented by:

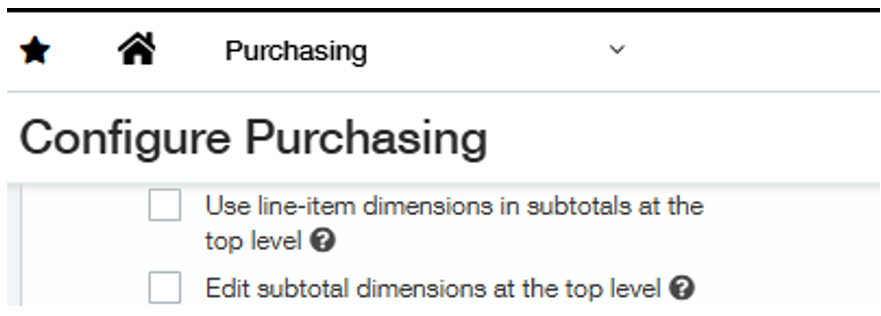

•turning on Use Advanced Tax schedules in Sage Intacct in the Purchasing Configuration

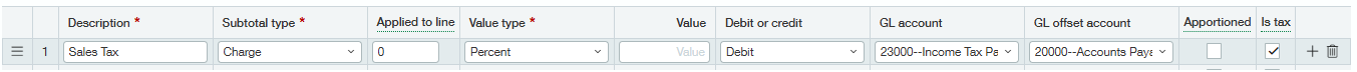

•setting up Subtotals on your invoice purchase transactions

The subtotal line for taxes will be designated as Is Tax and have a Value type of Percent.

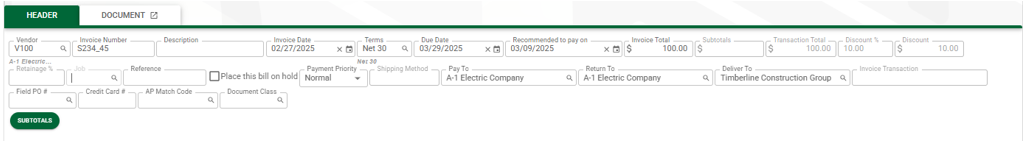

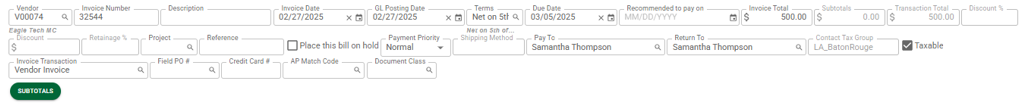

In Sage Intacct Paperless bridged to Intacct Sage, access the Subtotals section by clicking the Subtotals button on the Invoice Entry header.

Available subtotal options are based on the subtotals configured on the invoice purchasing transaction. The invoice purchasing transaction for a given invoice is populated into the Invoice Transaction field on the invoice header.

The ability to enter subtotals is only available after the Invoice Transaction field is populated in the invoice header. If the Subtotal button is clicked before populating the invoice transaction, or if the entered invoice transaction does not contain subtotals, the following message displays:

The Invoice Transaction field is systematically populated after you enter a Purchase Order, Subcontract or Invoice on a Debit Memo line. For non-commitment lines, if only a single invoice purchase transaction was configured in Purchasing Configuration on the Vault Bridge page, then the Invoice Transaction field will be systematically populated. If more than one invoice purchase transaction was configured for the non-commitment line type, you must select which invoice purchasing transaction to use.

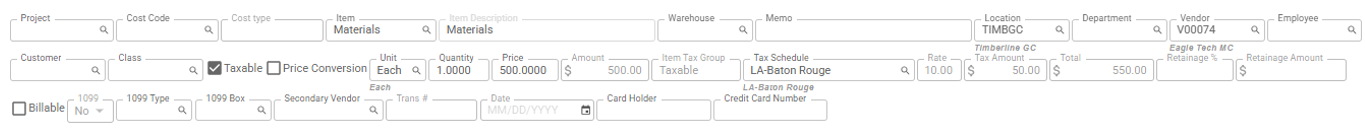

Taxes are based on a combination of the Contact Tax Group, Item Tax Group and Tax Schedule assigned to the lines. Taxes are calculated at the line level and systematically summed up on the tax subtotal line.

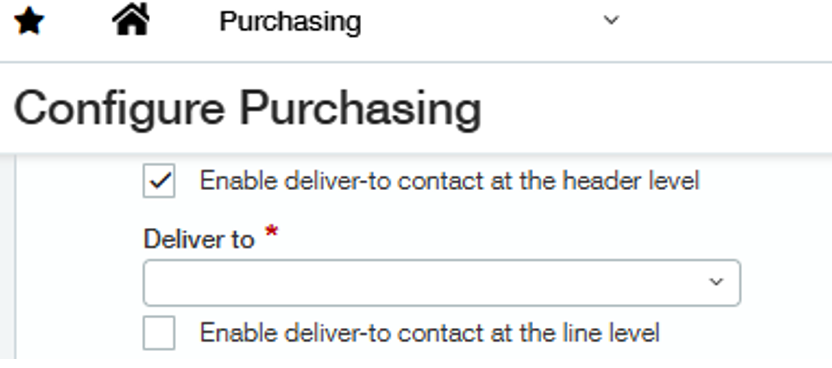

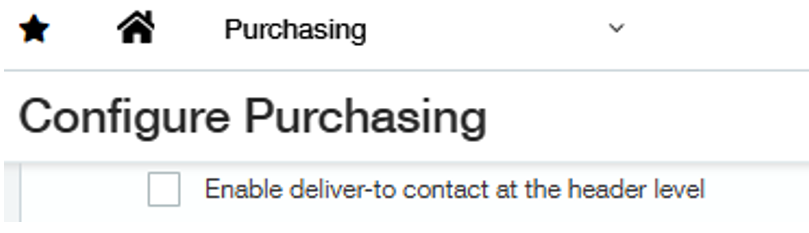

If the setting Enable deliver to contact at the header level is enabled in the Purchasing Configuration in Intacct, the Contact Tax Group is determined from the Delivery To Contact. Otherwise, it is determined from the Return To Contact in the invoice header. The Contact Tax Group and if contact is taxable display in the invoice header as read-only fields.

The Item Tax Group is determined from the Item on the line. The Item Tax Group and if the item is taxable display on the invoice line as read-only fields.

The Tax Schedule is populated based on your tax schedule map set up in Intacct. Both Contact and Item Tax Group must be taxable for taxes amount to calculate taxes.

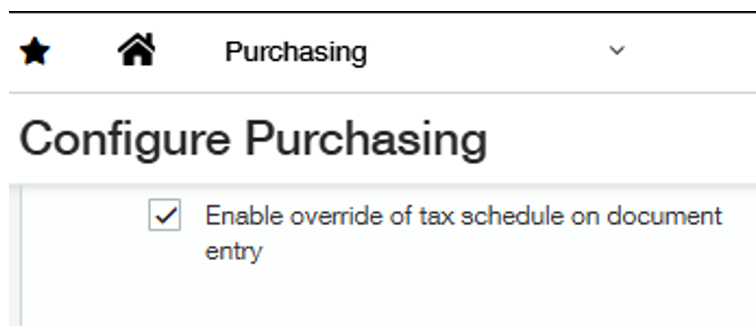

If Enable override of tax schedule on document entry option is enabled in the Purchasing Configuration in Intacct, the Tax Schedule field on the invoice line will be editable.

If Line-item tax option is enabled on the invoice purchasing transaction, the taxable flag on the invoice line will be editable.

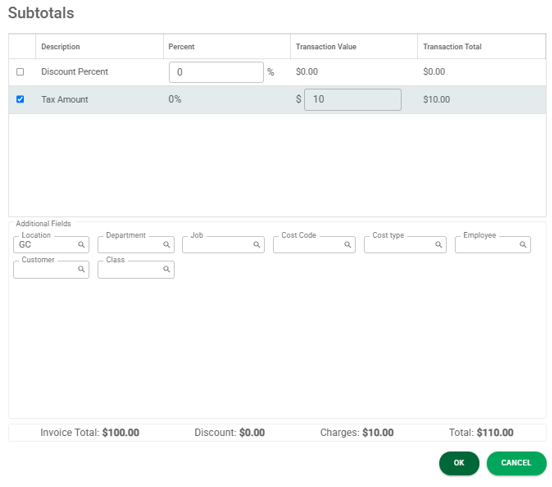

Clicking Subtotals opens a Subtotals window similar to the following:

Depending on the subtotal configuration on the invoice purchasing transaction, you will be able to edit either the percentage or the amount on the non-tax subtotal lines. As you select a subtotal line the available dimensions fields will display allowing you to code the subtotal line as needed. At least one line on the invoice must be marked as taxable to add an amount to the subtotal tax lines.

If you bridged to the Top Level and did not enable Edit subtotals dimensions at the top level in the purchasing configuration, dimension fields will not be available to coding on the subtotals forms.

The Subtotals field in the invoice header will display the sum of all subtotal lines. The subtotals will also update automatically as you change your data on your invoice. There is no need to click Calculate Subtotals like in Sage Intacct.

If you have configured subtotals on your order transaction definitions and applied tax at the time you enter your purchase order or subcontracts, taxes will be calculated on your invoice transaction at the time you select the Purchase Order, Subcontract or Invoice on a Debit Memo line.

Support for Enable deliver to contact at the line level has not been implemented; however support for this setting is on our road map.